TABLE OF CONTENTS

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| | | | |

¨ | ☐

| Preliminary Proxy Statement |

☐

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | ☒

| Definitive Proxy Statement |

| |

¨ | ☐

| Definitive Additional Materials |

| |

¨ | ☐

| Soliciting Material under Rule 14a-12 |

NISOURCE INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

|

NISOURCE INC. |

(Name of registrant as specified in its charter) |

|

|

(Name of person(s) filing proxy statement, if other than the registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

☒ | |

x | | No fee required. |

| | | | | | |

¨☐ | | | Fee paid previously with preliminary materials. |

| | | | | | |

☐ | | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid:

|

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | | | |

| | (3) | | Filing Party:

|

| | | | |

| | (4) | | Date Filed:

|

| | | | |

TABLE OF CONTENTS

801 E. 86

th Avenue • Merrillville, Indiana 46410 • (877) 647-5990To the Holders of

Our Common

Stock of NiSource Inc.:Stock:

The

2022 annual meeting of

the stockholders (the “Annual Meeting”) of NiSource Inc., a Delaware corporation,

(the “Company”), will be

held at the Hyatt Rosemont, 6350 N. River Road, Rosemont, Illinois 60018conducted in a virtual format only via live audio webcast on

Wednesday,Tuesday, May

11, 2016,24, 2022, at 10:00 a.m.

, local time, Central Time at www.virtualshareholdermeeting.com/NI2022, for the following purposes:

(1)

| (1) | To elect ninetwelve directors named in the proxy statement to hold office until the next annual stockholders’ meeting and until their respective successors have been elected or appointed and qualified; |

(2)

| (2) | To approve named executive officer compensation on an advisory basis; |

(3)

| (3) | To ratify the appointment of Deloitte & Touche LLP as the Company’sour independent registered public accountantsaccounting firm for the year 2016; 2022; |

(4)

| (4) | To act uponconsider a stockholder proposal reducing the threshold stock ownership requirement for stockholders to call a special stockholder proposals described in the proxy statement that are properly presented at the meeting;meeting from 25% to 10%; and |

(5)

| (5) | To transact such other business as may properly come before the meetingAnnual Meeting and any adjournment or postponement thereof. |

All persons

The Annual Meeting will be conducted in a virtual format only to provide access to all of our stockholders regardless of geographic location. There is no in-person meeting for you to attend. We designed the format of the Annual Meeting to ensure that our stockholders who wereattend the Annual Meeting will be afforded similar rights and opportunities to participate as they would at an in-person meeting.

All stockholders of record

atas of the close of business on March

15, 2016, will be entitled30, 2022, are eligible to vote at the Annual Meeting and any adjournment

or postponement thereof.

Your vote is very important. Whether or not you plan to attend the

meeting,virtual Annual Meeting, please vote at your earliest

convenience. You may vote your sharesconvenience by

marking, signing, datingtelephone, through the Internet or by completing and mailing the enclosed proxy card.

YouIf you later choose to revoke your proxy or change your vote, you may

also vote by telephone or through the Internetdo so by following the

instructions set forth onprocedures described in the

attached proxy

card. If you attend the Annual Meeting, you may be able to vote your shares in person, even if you have previously submitted a proxy.statement. See the section

“Voting in Person”“Attending and Voting During the Virtual Annual Meeting” for specific instructions on voting your

shares.If you plan to attendshares at the Annual Meeting, please so indicate in the space provided on the proxy card or respond when prompted on the telephone or through the Internet.

Meeting.

PLEASE VOTE YOUR SHARES

AS SOON AS POSSIBLE BY TELEPHONE, THROUGH THE INTERNET OR BY PROMPTLY MARKING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD.

Samuel K. Lee

Corporate Secretary

| | | |

| | | Kimberly S. Cuccia |

| | | Senior Vice President, General Counsel and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials

For for the Annual Meeting

of Stockholders to be Held on May

11, 201624, 2022

The Proxy Statement, Notice of Annual Meeting and

20152021 Annual Report to Stockholders

are available at

http:https://ir.nisource.com/annuals.cfmwww.nisource.com/filingsTABLE OF CONTENTS

This summary highlights information that may be expanded upon elsewhere in this proxy statement (“Proxy Statement”). This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement before voting. The accompanying proxy is solicited on behalf of the Board of Directors of NiSource Inc. (the “Board”) for the 20162022 annual meeting of the stockholders (the “Annual Meeting”).

2022 ANNUAL MEETING OF STOCKHOLDERS

| | Time and Date: | | | 10:00 a.m. Central Time

on Tuesday, May 24, 2022 | |

| | Website: | | | www.virtualshareholdermeeting.com/NI2022 | |

| | Record Date: | | | March 30, 2022 | |

| | Shares of Common Stock Outstanding on Record Date: | | | 405,734,408 | |

| | Voting: | | | Each share is entitled to one vote for each director to be elected and on each matter to be voted upon at the Annual Meeting. | |

This Proxy Statement and the accompanying proxy card are first being sent to stockholders on April 19, 2022.

VOTING MATTERS AND BOARD RECOMMENDATIONS

| | Proposal 1 | | | To elect twelve directors named in this proxy statement; | | | For All Nominees | | | | |

| | Proposal 2 | | | To approve the compensation of our named executive officers (the “Named Executive Officers”) on an advisory basis; | | | For | | | | |

| | Proposal 3 | | | To ratify Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for 2022; and | | | For | | | | |

| | Proposal 4 | | | To consider a stockholder proposal reducing the threshold stock ownership requirement for stockholders to call a special stockholder meeting from 25% to 10%. | | | Against | | | | |

2022 Proxy Statement | 1

2022 Proxy Statement | 1

TABLE OF CONTENTS

BOARD OF DIRECTORS NOMINEES

| | Peter A. Altabef | | | 62 | | | 2017 | | | Chair & CEO,

Unisys Corporation | | | | | | | | | ✔* | | | | | | ✔ | |

| | Sondra L. Barbour | | | 59 | | | 2022 | | | Retired EVP, Lockheed Martin Corporation | | | ✔ | | | | | | ✔ | | | | | | | |

| | Theodore H. Bunting Jr. | | | 63 | | | 2018 | | | Retired Group President, Entergy Corporation | | | ✔* | | | | | | | | | | | | ✔ | |

| | Eric L. Butler | | | 61 | | | 2017 | | | President and CEO, Aswani-Butler Investment Associates | | | | | | ✔* | | | | | | | | | ✔ | |

| | Aristides S. Candris | | | 70 | | | 2012 | | | Retired President & CEO, Westinghouse | | | | | | | | | | | | ✔* | | | ✔ | |

| | Deborah A. Henretta | | | 61 | | | 2015 | | | Partner, G100 Companies; Retired Group President, Procter & Gamble Co. | | | ✔ | | | ✔ | | | | | | | | | | |

| | Deborah A. P. Hersman | | | 52 | | | 2019 | | | Retired Chief Safety Officer and Consultant at Waymo LLC | | | | | | | | | ✔ | | | ✔ | | | | |

| | Michael E. Jesanis | | | 65 | | | 2008 | | | Retired President & CEO, National Grid USA | | | | | | ✔ | | | | | | ✔ | | | | |

| | William D. Johnson | | | 68 | | | 2022 | | | Retired President & CEO, Pacific Gas & Electric Corporation | | | | | | ✔ | | | | | | ✔ | | | | |

| | Kevin T. Kabat | | | 65 | | | 2015 | | | Chair of the Board,

NiSource Inc. | | | | | | | | | | | | | | | ✔* | |

| | Cassandra S.

Lee | | | 53 | | | 2022 | | | Chief Audit Executive,

AT&T Inc. | | | ✔ | | | | | | ✔ | | | | | | | |

| | Lloyd M. Yates | | | 61 | | | 2020 | | | President & CEO,

NiSource Inc. | | | | | | | | | | | | | | | | |

(1)

| Mss. Barbour and Lee and Mr. Johnson joined the committees listed effective March 15, 2022. |

* Chair of Committee

See “Proposal 1 – Election of Directors” for more information on our director nominees.

2 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

CORPORATE GOVERNANCE HIGHLIGHTS

| | ✔ | | | Annual election of directors | |

| | ✔ | | | Majority voting for all directors with resignation policy | |

| | ✔ | | | No supermajority voting provisions | |

| | ✔ | | | No stockholder rights plan (“poison pill”) | |

| | ✔ | | | Proxy access by-law (3% ownership / 3 years duration / up to 20 stockholders / 20% of board) | |

| | ✔ | | | Stockholder right to call special meetings | |

| | ✔ | | | Separate chair and CEO | |

| | ✔ | | | All directors independent except CEO | |

| | ✔ | | | Board committees comprised of all independent directors | |

| | ✔ | | | Regular executive sessions of independent directors | |

| | ✔ | | | Annual Board and committee evaluation process and ongoing evaluations of individual directors | |

| | ✔ | | | Strategic and risk oversight by Board and committees | |

| | ✔ | | | Annual “Say-on-Pay” advisory votes | ��� |

| | ✔ | | | Strong alignment between pay and performance in incentive plans | |

| | ✔ | | | Commitment to safety and customer care | |

| | ✔ | | | Political contributions disclosure | |

| | ✔ | | | Enhanced independent registered public accounting firm disclosure | |

See “Corporate Governance” for more information on our corporate governance practices.

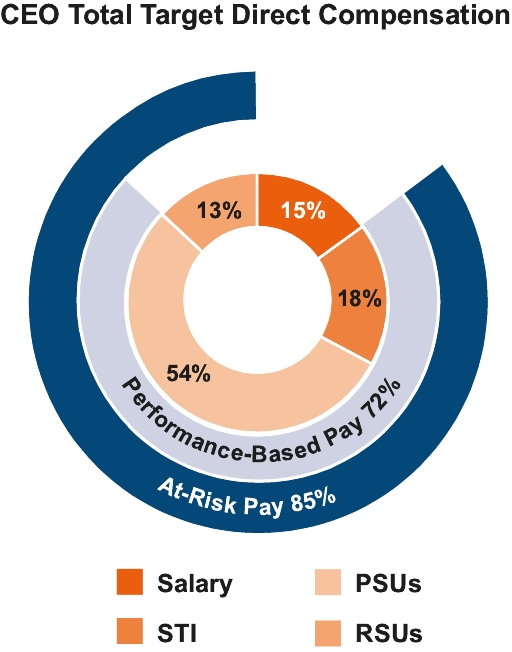

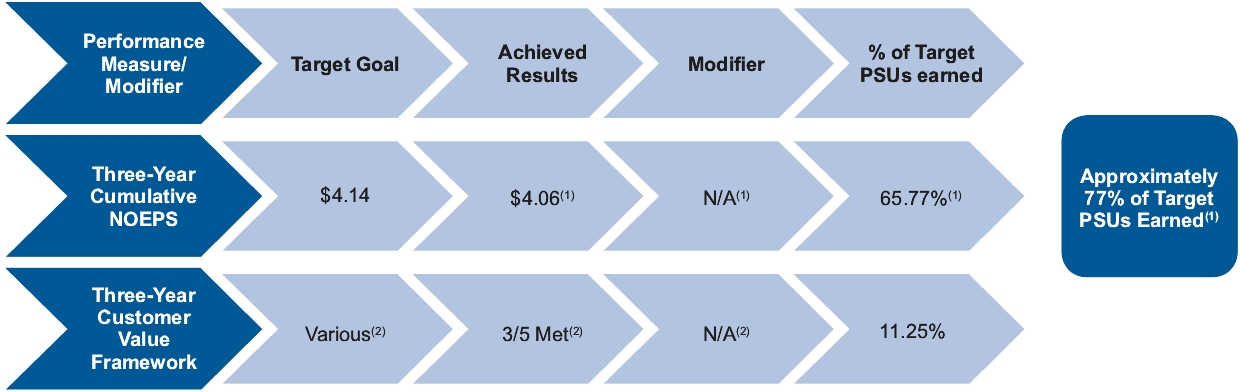

EXECUTIVE COMPENSATION HIGHLIGHTS

We have designed our executive compensation program to meet our business objectives using various compensation elements intended to drive both long-term and short-term performance. We believe that a significant portion of total compensation should consist of at-risk performance-based compensation. Our executive compensation practices include the following, each of which the Compensation and Human Capital Committee believes reinforces our executive compensation policy and objectives.

See “Compensation Discussion and Analysis (CD&A)” and “2021 Executive Compensation” for more information on our executive compensation program.

| | ✔ | | | Incentive award metrics that are tied to key company performance measures | | | ✘ | | | Repricing of options without stockholder approval | |

| | ✔ | | | Share ownership guidelines applicable to executive officers and independent directors | | | ✘ | | | Hedging or pledging transactions or short sales by executive officers or directors | |

| | ✔ | | | Compensation recoupment policy | | | ✘ | | | Tax gross-ups for Named Executive Officers | |

| | ✔ | | | Limited perquisites | | | ✘ | | | Automatic single-trigger equity vesting upon a change-in-control | |

| | ✔ | | | Prohibition against pledging unearned shares in our long-term incentive plan | | | ✘ | | | Excise tax gross-ups under change-in-control agreements | |

| | ✔ | | | Double-trigger severance benefits upon a change-in-control | | | ✘ | | | Excessive pension benefits or defined benefit supplemental executive retirement plan | |

| | ✔ | | | One-year minimum vesting for equity awards | | | ✘ | | | Excessive use of non-performance based compensation | |

| | ✔ | | | Significant portions of the executive compensation opportunity that are entirely contingent on performance against pre- established performance goals | | | ✘ | | | Excessive severance benefits | |

| | ✔ | | | Independent compensation consultant | | | ✘ | | | Dividend equivalent rights or dividends on unvested performance shares or restricted stock units granted to executive officers | |

| | ✔ | | | Annual Say-on-Pay vote by stockholders | | | | | | | |

2022 Proxy Statement | 3

2022 Proxy Statement | 3TABLE OF CONTENTS

GENERAL INFORMATION

Stock Symbol: NI

Stock Exchange: NYSE

Registrar and Transfer Agent: Computershare Investor Services

State of Incorporation: Delaware

Corporate Headquarters: 801 E. 86th Avenue, Merrillville, Indiana 46410

Corporate Website: www.nisource.com

BUSINESS AND STRATEGY

NiSource Inc. is an energy holding company under the Public Utility Holding Company Act of 2005 whose primary subsidiaries are fully regulated natural gas and electric utility companies serving approximately 3.7 million customers in six states.

We focus our business strategy on providing safe and reliable electric and natural gas service through our core, rate-regulated asset-based utilities, which generate substantially all of our operating income. Our utilities continue to move forward on core safety, infrastructure and environmental investment programs supported by complementary regulatory and customer initiatives across all states in which we operate. Our goal is to develop strategies that benefit all stakeholders as we embark on long-term infrastructure investment and safety programs to better serve our customers, align our tariff structures with our cost structure, and address changing customer conservation patterns. These strategies focus on improving safety and reliability, enhancing customer service, ensuring customer affordability and reducing emissions while generating sustainable returns.

The safety of our customers, communities and employees has been and remains our top priority. Our safety management system (SMS) is an established operating model within NiSource. With the continued support and advice from our Quality Review Board (a panel of third parties with safety operations expertise engaged by management to advise on safety matters), we are continuing to mature our SMS processes, capabilities, and talent as we collaborate within and across industries to enhance safety and reduce operational risk. Additionally, we continue to pursue regulatory and legislative initiatives that will allow residential customers not currently on our system to obtain gas service in a cost-effective manner. For more information on our safety program, see our inaugural 2021 Safety Report at www.nisource.com.

We continue to actively implement our plans to reduce Scope 1 greenhouse gas (GHG) emissions by 90% from 2005 levels by 2030, and to significantly reduce methane emissions, a component of Scope 1 GHG emissions. These plans include the retirement of coal-fired electric generation, increased sourcing of renewable energy, methane reductions from priority pipeline replacement, traditional leak detection and repair, and deployment of advanced leak detection and repair. Additionally, we are active in several efforts to accelerate the development and demonstration of lower-carbon energy technologies and resources, such as hydrogen and renewable natural gas (RNG), to enable affordable pathways to economy-wide decarbonization. For more information on environmental and related matters, see our 2021 Integrated Annual Report, our 2021 Climate Report and the “Sustainability” section of our website at www.nisource.com.

NiSource is keenly aware that in addition to being a business entity, we are also a social and community enterprise that includes our employees, partners, customers and the communities we serve. For more information about our corporate responsibility diversity and sustainability efforts, see our 2021 Integrated Annual Report and the “Sustainability” and “Diversity, Equity and Inclusion” sections of our website at www.nisource.com.

For more information on our business and strategy, see our 2021 Integrated Annual Report, located at www.nisource.com.

Our directors possess the necessary breadth and depth of skills and experience to oversee our business operations and long-term strategy as set forth in “Proposal 1 – Election of Directors – Nominee Demographics, Skills and Biographies.”

4 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

The accompanying proxy is solicited on behalf of the Board for the Annual Meeting to be held

at the Hyatt Rosemont, 6350 North River Road, Rosemont, Illinois 60018 on

Wednesday,Tuesday, May

11, 2016,24, 2022 at 10:00 a.m.

, local time. Central Time, in a virtual format only via live audio webcast at www.virtualshareholdermeeting.com/NI2022. The common stock, $.01 par value per share, of the Company represented by the

accompanying proxy will be voted as directed. If you return a signed proxy card without indicating how you want to vote your shares, the shares represented by the accompanying proxy will be voted as recommended by the

Board “FOR” all of the nominees for director; “FOR” advisory approval of the compensation of the Company’s Named Executive Officers; “FOR” the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accountants for 2016; “AGAINST” the stockholder proposal regarding reports on political contributions; “AGAINST” the stockholder proposal regarding a senior executive equity retention policy; and “AGAINST” the stockholder proposal regarding accelerated vesting of equity awards of senior executives upon a change in control.Board:

| ■ | “FOR” all of the nominees for director; |

| ■ | “FOR” advisory approval of the compensation of our Named Executive Officers; |

| ■ | “FOR” the ratification of the appointment of Deloitte as our independent registered public accounting firm for 2022; and |

| ■ | “AGAINST” the stockholder proposal to reduce the threshold stock ownership requirement for stockholders to call a special stockholder meeting from 25% to 10%. |

This Proxy Statement and the accompanying proxy card are first being sent to stockholders on April

7, 2016.19, 2022. We will bear the expense of this mail solicitation, which may be supplemented by telephone, facsimile,

e-mailemail and personal solicitation by our officers, employees and agents. To aid in the solicitation of proxies, we have retained D.F. King for a fee of $9,500, plus reimbursement of expenses. We may incur additional fees if we request additional services. We will also request brokerage houses and other nominees and fiduciaries to forward proxy materials, at our expense, to the beneficial owners of stock held

as of 5:00 p.m. Eastern Time on March

15, 2016,30, 2022, the record date for voting.

We use the terms “NiSource,” the “Company,” “we,” “our” and “us” in this

proxy statementProxy Statement to refer to NiSource Inc.

Holders of shares of common stock as of the close of business on March

15, 2016,30, 2022, are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of March

15, 2016, 320,722,00530, 2022, 405,734,408 shares of common stock were issued and outstanding. Each share of common stock outstanding on that date is entitled to one vote on each matter presented at the Annual Meeting.

If you are a “stockholder of record” (that is, if your shares of common stock are registered directly in your name on the Company’s records), you may vote your shares by proxy

in advance of the Annual Meeting using any of the following methods:

| ■ | Telephoning the toll-free number listed on the proxy card; |

| ■ | Using the Internet website listed on the proxy card: www.proxyvote.com; or |

| ■ | Marking, dating, signing and returning the enclosed proxy card. |

Telephoning the toll-free number listed on the proxy card;

Using the Internet website listed on the proxy card; or

Marking, dating, signing and returning the enclosed proxy card.

All votes must be received by the proxy tabulator by 11:59 p.m. Eastern Time on May 10, 2016.

23, 2022.

If your shares are held in a brokerage account or by a bank,

broker, trust or other

stockholder of recordnominee (herein referred to as a “Broker”), you are considered a “beneficial owner” of shares held in “street name.” As a beneficial owner, you will receive proxy materials and voting instructions from the stockholder of record that holds your shares. You must follow the voting instructions in order to have your shares of common stock voted.

Discretionary Voting by Brokers

Banks and

Other Stockholders of Record“Broker Non-Votes”

If your shares are held in street name and you do not provide the Broker with instructions as to how to vote such shares, your Broker will only be able to vote your shares at its discretion on certain “routine” matters as permitted by New York Stock Exchange (“NYSE”) rules. The proposal to ratify the appointment of our independent registered public accountants

2022 Proxy Statement | 5

2022 Proxy Statement | 5TABLE OF CONTENTS

accounting firm is the only proposal considered a routine matter and, accordingly, at the Annual Meeting, Brokers will only have discretionary authority to vote your shares

with regard toregarding Proposal No. 3, the ratification of the appointment of Deloitte as our independent registered public

accountantsaccounting firm for

2016.2022. A “broker non-vote” occurs when a Broker holding shares for a beneficial owner does not have discretionary authority to vote the shares and has not received instructions from the beneficial owner as to how the beneficial owner would like the shares to be voted. Brokers will not have discretionary authority to vote your shares with respect to the

election of directors,other proposals to be presented at the

advisory approval of executive compensation, or the stockholder proposals.Annual Meeting. Therefore, it is important that you instruct your Broker or other nominee how to vote your shares.

If Brokers exercise their discretionary voting authority on Proposal No. 3, such shares will be considered present at the Annual Meeting for quorum purposes and broker non-votes will occur as to each of the other proposals presented at the Annual Meeting, which are considered “non-routine.”

Voting Shares Held in

a 401(k) PlanOur 401(k) Plan and the

If you hold your shares of common stock in our 401(k) Plan,

of Columbia Pipeline Group, Inc. (“CPG”) each holdthose shares

of our common stock. All of these shares (collectively, “Plan Shares”) are held in the name of Fidelity Management Trust Company (“Fidelity”),

which administers eachthe administrator of

these plans.the 401(k) Plan. You will receive a proxy card that includes the number of shares of our common stock held in

yourthe 401(k)

. Plan. You should instruct Fidelity how to vote your shares by completing and returning the proxy card or by voting your shares by Internet or by telephone, as detailed above under “Voting Your Proxy.” If you do not instruct Fidelity how to vote your shares, or if you sign the proxy card with no further instructions as to how to vote your shares, Fidelity will vote your

Plan Sharesshares in the same proportion as the shares for which it receives instructions from all other participants to the extent permitted under applicable law. To allow enough time for Fidelity to vote your

Plan Sharesshares in accordance with your direction, your voting instructions must be received by Fidelity no later than 11:59 p.m. Eastern Time on May

8, 2016.19, 2022.

Attending and Voting

During the Virtual Annual Meeting Format of Meeting. The Annual Meeting will be conducted in PersonYou also may comea virtual format only to provide access to all our stockholders regardless of geographic location. There is no in-person meeting for you to attend. We designed the format of the Annual Meeting to ensure that our stockholders who attend the Annual Meeting will be afforded similar rights and voteopportunities to participate as they would at an in-person meeting.

Attending the Meeting. You are entitled to attend and participate in the Annual Meeting if you were a stockholder of record as of the close of business on March 30, 2022, the record date, or hold a legal proxy for the Annual Meeting provided by your Broker as described below. To attend and participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/NI2022 and enter your 16-digit control number, which can be found on your proxy card, voting instruction form or email you received with your proxy materials. If your shares in personare held by obtaininga Broker and submittingyou do not have a ballotcontrol number, please contact your Broker as soon as possible so that willyou can be provided with a control number.

Voting During the Meeting. You may vote during the Annual Meeting by following the instructions available aton the meeting website during the meeting. However, ifIf your shares are held in street name by a Broker, then, in order to be able to vote at the meeting,Annual Meeting, you must obtain an executed legal proxy from the Broker indicating that you were the beneficial owner of the shares on March 15, 2016,30, 2022, the record date for voting, and that the Broker is giving you its proxy to vote the shares.If your shares are held in our 401(k) Plan or CPG’sthe 401(k) Plan, you will not be able to vote your shares at the meeting.

Votes cast in personAnnual Meeting. Whether or represented by proxy at the meeting will be tabulated by the inspectors of election.

Ifnot you plan to attend the Annual Meeting, please so indicate whenwe urge you to vote so that we may send you an admission ticket and make the necessary arrangements. Stockholders who plan to attendsubmit your proxy in advance of the meeting must present picture identification alongby one of the methods described above under “Voting Your Proxy.” Votes cast at the Annual Meeting or represented by proxy at the Annual Meeting will be tabulated by the inspector of election.

Technical Assistance. The Annual Meeting will begin promptly at 10:00 a.m. Central Time. We encourage you to access the Annual Meeting approximately 15 minutes in advance to allow ample time for you to log in to the meeting and test your computer audio system. We recommend that you carefully review the above procedures needed to gain admission in advance. Technicians will be ready to assist you with an admission ticketany technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or evidenceduring the meeting, please call the technical support number that will be posted on the meeting login page at www.virtualshareholdermeeting.com/NI2022.

6 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

Submitting Questions During the Meeting. As part of beneficial ownership.the Annual Meeting, we will hold a live question and answer session during which we intend to answer questions submitted during the meeting that are relevant to the purposes of the meeting and the Company's business in accordance with the Annual Meeting procedures posted on the meeting website, as time permits. Questions may be submitted by stockholders that have used 16-digit control numbers to enter the meeting at

www.virtualshareholdermeeting.com/NI2022. Questions and answers may be grouped by topic and substantially similar questions may be grouped and answered once. You may revoke your proxy at any time before a vote is taken or the authority granted is otherwise exercised. To revoke a proxy, you may send a letter to

the Company’sour Corporate Secretary (which must be received before a vote is taken) indicating that you want to revoke your proxy, or you can supersede your initial proxy by submitting a duly executed proxy bearing a later date, voting by telephone or through the Internet on a later date, or attending the

meetingvirtual Annual Meeting and voting

in person.during the meeting. Attending the

virtual Annual Meeting will not in and of itself revoke a proxy.

A quorum of stockholders is necessary to take action at the Annual Meeting. A majority of the outstanding shares of common stock, present in personduring the virtual Annual Meeting or represented by proxy, will constitute a quorum at the Annual Meeting. The inspectors of election appointed for the Annual Meeting will determine whether or not a quorum is present. The inspectors of election will treat abstentions and broker non-votes as present and entitled to voteAbstentions are counted for purposes of determining whether a quorum is present. As explained above under “Discretionary Voting by Brokers and ‘Broker Non-Votes’,” if Brokers exercise their discretionary voting authority on Proposal No. 3, such shares will be considered present at the presence of a quorum. Ameeting for quorum purposes and broker non-vote occurs when a Broker holding shares for a beneficial owner does not have discretionary authority to vote the shares and has not received instructions from the beneficial ownernon-votes will occur as to howeach of the beneficial owner would likeother proposals presented at the shares to be voted.Annual Meeting.

2022 Proxy Statement | 7

2022 Proxy Statement | 7TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

At the recommendation of the Nominating and Governance Committee, the Board has nominated the persons listed below to serve as directors, each for a one-year term, beginning at the Annual Meeting on May

11, 2016,24, 2022, and expiring at the

20172023 annual meeting of

the Company’sour stockholders (the

“2017“2023 Annual Meeting”) and until their successors are duly elected or appointed and qualified. The nominees include

eighteleven independent directors, as defined in the applicable rules of the NYSE, and our President and Chief Executive Officer (“CEO”). The Board does not anticipate that any of the nominees will be unable to serve, but if any nominee is unable to serve, the proxies will be voted in accordance with the judgment of the person or persons voting the proxies.

All of the nominees currently serve on the Board.

The following chart gives Set forth below is information aboutregarding all our nominees (each of whom has consented to being named in the proxy statementProxy Statement and to serving, if elected).

To be elected, a nominee must receive more votes cast in favor of his or her election than against election. Abstentions by those present or represented by proxy and broker non-votes will not be votedcounted as a vote cast either “for” or “against” with respect to the election of directors and, therefore, will have no effect on the outcome. Brokers will not have discretionary authority to vote on the election of directors. Accordingly, there could be broker non-votes which will have no effect on the vote.

Under our Corporate Governance Guidelines, each nominee will tender a conditional resignation prior to the Annual Meeting, effective only if both (a) the votes “against” a nominee’s election exceed the votes “for” election (a “failed re-election”) and (b) such resignation is subsequently accepted by the Board. Any failed re-election will be referred to the Nominating and Governance Committee, which will make a recommendation to the Board as to whether to accept or reject the resignation. The Board will decide and publicly disclose its decision, the rationale for the decision and the directors who participated in the process within 90 days after the election. The Board expects the director who has not been re-elected to abstain from participating in the Nominating and Governance Committee or Board discussion or vote regarding whether to accept his or her resignation offer. A director who has had a failed re-election may participate in discussions or votes with respect to other directors who have had a failed re-election.

Nominee Demographics, Skills and Biographies

Our director nominees are diverse and possess the necessary breadth and depth of skills and experience to oversee our business operations and long-term strategy as shown in the tables and biographies below.

8 |  2022 Proxy Statement

2022 Proxy Statement

TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | ✔ | | | Industry Experience (58%) * | |

| | ✔ | | | Other Operations / Customer Service (100%) | |

| | ✔ | | | Government and Regulatory (100%) | |

| | ✔ | | | Public Company Board (92%) | |

| | ✔ | | | Financial or Capital Markets (75%) | |

| | ✔ | | | Risk Management (100%) | |

| | ✔ | | | Technology (67%) | |

| | ✔ | | | Safety (67%) | |

| | ✔ | | | Environmental, Sustainability, Corporate Responsibility and Ethics (100%) | |

| | ✔ | | | Non-Profit Board / Community Service (92%) | |

| | ✔ | | | CEO (Current or Prior) (67%) | |

| | ✔ | | | Strategic Planning (100%) | |

| | ✔ | | | Financial Literacy and Expertise (100%) | |

| | ✔ | | | Talent Management (Executive Compensation and Benefits, and Talent Development) (100%) | |

* Percentages shown in this table represent the portion of the Board with the indicated skill or experience.

2022 Proxy Statement | 9

2022 Proxy Statement | 9TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

THE BOARD

UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW.

| | PETER A. ALTABEF | |

|  Name, AgeAge: 62Director Since: 2017Standing Board Committees:■ Finance Committee (Chair)

■ Nominating and Principal Occupationsfor Past Five Years and Directorships Held

Governance Committee | | Has Been a

Director Since |

| | |

Richard A. Abdoo, 72

| | 2008 |

| |

Since May 2004,

Executive Experience: Mr. Abdoo has been President of R.A. Abdoo & Co. LLC, Milwaukee, Wisconsin, an environmental and energy consulting firm. Prior thereto, Mr. Abdoo was ChairmanAltabef currently serves as Chair and CEO of Wisconsin EnergyUnisys Corporation, from 1991 until his retirementa global information technology company, a position he has held since January 2015 (becoming Chair in April 2004.2018). He also served as President from January 2015 through March 2020 and from December 2021 to present. Prior to his current role, he served as president and CEO of Wisconsin EnergyMICROS Systems, Inc., a provider of integrated software and hardware solutions to the hospitality and retail industries, from 2013 to 2014, when it was acquired by Oracle Corporation. Before that, he served as president and CEO of Perot Systems Corporation from 19912004 to April 2003.2009, when it was acquired by Dell Inc. Following that transaction, Mr. AbdooAltabef served as president of Dell Services, the information technology services and business process solutions unit of Dell Inc., until his departure in 2011.

Outside Board and Other Experience: Mr. Altabef is Chair of the board of directors of Unisys Corporation. He is also a member of the President’s National Security Telecommunications Advisory Committee (NSTAC), a trustee of the Committee for Economic Development (CED), a member of the advisory board of Merit Energy Company, LLC and of the board of directors of Petrus Trust Company, LTA. He has previously served as a senior advisor to 2M Companies, Inc., in 2012, and as a director of A.K. SteelMICROS Systems, Perot Systems Corporation and EnSync, Inc. | | |

| |

By virtueBelo Corporation. He is also active in community service activities, having served on the boards and committees of his former positionsseveral cultural, medical, educational and charitable organizations and events.

Skills and Qualifications: Mr. Altabef has experience leading large organizations as Chairman and CEO of a large electric and gas utility holding company, as well as his current positions as director of one other energy-related company and a steel maker that is a major userstrong background in strategic planning, financial reporting, risk management, business operations and corporate governance. He also has more than 25 years of energy, Mr. Abdoo has extraordinary expertise andsenior leadership experience withat some of the issues facing the energy industry in general and public utilities in particular.world’s leading information technology companies. As a former CEO, Mr. Abdooresult, he has a deep understanding aboutof the cybersecurity issues facing executivebusinesses today. His overall leadership experience and his cybersecurity background provide the Board with valuable perspective and insight into significant issues that we face. | |

10 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | SONDRA L. BARBOUR | |

| |  Age: 59Director Since: 2022Standing Board Committees: Age: 59Director Since: 2022Standing Board Committees:■ Audit Committee

■ Finance Committee | | | Executive Experience: Ms. Barbour retired as Executive Vice President, Information Systems and Global Solutions, of Lockheed Martin Corporation (“Lockheed Martin”) in 2016 and served in a transition role at Leidos Holdings until her retirement in 2017. Ms. Barbour joined Lockheed Martin in 1986 and served in various leadership capacities and has extensive technology experience, notably in the design and development of large-scale information systems. From 2008 to 2013 Ms. Barbour served as Senior Vice President, Enterprise Business Services and Chief Information Officer, heading all of Lockheed Martin's internal information technology operations, including protecting the company's infrastructure and information from cyber threats. Prior to that role Ms. Barbour served as Vice President, Corporate Shared Services and Vice President, Corporate Internal Audit providing oversight of supply chain activities, internal controls, and risk management.

Outside Board and Other Experience: Ms. Barbour serves as a director of AGCO Corporation, where she chairs the Audit Committee, and was previously a director for 3M Company.

Skills and Qualifications: Ms. Barbour’s significant experience with information technology systems and cyber security is valuable in helping steer our development of technology and management of cyber risks. Ms. Barbour brings 30 years of leadership experience at Lockheed Martin, where she oversaw complex information technology systems of a major corporation. 110,000+ employee business. She brings significant risk management knowledge related to technology and supply chain oversight, which are of key importance to our success. Ms. Barbour also enhances the Board’s public company experience in the areas of internal controls, accounting, audit, risk management and cybersecurity. | |

| | THEODORE H. BUNTING, JR. | |

| |  Age: 63Director Since: 2018Standing BoardCommittees: Age: 63Director Since: 2018Standing BoardCommittees:■ Audit Committee (Chair)

■ Nominating and

Governance Committee | | | Executive Experience: Mr. Abdoo’s credentialsBunting most recently served as group president, utility operations, at Entergy Corporation (“Entergy”), an integrated energy company, from 2012 until his retirement in 2017. Before that, he was senior vice president and chief accounting officer at Entergy from 2007 to 2012, and chief financial officer (“CFO”) of several subsidiaries from 2000 to 2007. He held other management positions of increasing responsibility in accounting and operations at Entergy since joining the company in 1983.

Outside Board and Other Experience: Mr. Bunting has been a director of Unum Group since 2013 and is currently chair of its regulatory compliance committee and a member of its human capital committee. Mr. Bunting has been a director of the Hanover Group since 2020 and is a member of the Audit Committee. Mr. Bunting has been a director at IEA since 2021 and is a member of the Nominating and Governance and Compensation Committees. He previously served as a registered professional engineerdirector of Imation Corp., a global data storage and information security company. He also serves on the board of Foundation for the Mid South and previously served on the board of Hendrix College.

Skills and Qualifications: Mr. Bunting's utility industry knowledge, including his experience in several states allowcustomer service, safety and regulatory relations, are valuable to us as we continue to execute on our robust long-term utility infrastructure investment plans. He also brings additional public company experience in the areas of strategic finance, accounting, auditing, and capital and risk management to the Board. He is a certified public accountant. | |

2022 Proxy Statement | 11

2022 Proxy Statement | 11TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | ERIC L. BUTLER | |

| |  Age: 61Director Since: 2017Standing Board Committees: Age: 61Director Since: 2017Standing Board Committees:■ Compensation and Human Capital Committee (Chair)

■ Nominating and

Governance Committee | | | Executive Experience: Mr. Butler currently is President and CEO of Aswani-Butler Investment Associates, a private equity investment firm. Previously he served in a number of executive leadership roles at Union Pacific Corporation (“Union Pacific”), a transportation company located in Omaha, Nebraska, until his retirement in February 2018. He began his career at Union Pacific in 1985 and held leadership roles in financial planning and analysis and in marketing, sales and commercial, including as Executive Vice President and Chief Marketing Officer from March 2012 to December 2016. He also held leadership roles in supply, procurement and purchasing, including as Vice President and General Manager – Industrial Products from April 2005 to March 2012. He was Senior Vice President of Union Pacific from December 2017, Executive Vice President and Chief Administrative Officer from December 2016 through November 2017, and Corporate Secretary from February 2017 through November 2017.

Outside Board and Other Experience: Mr. Butler was appointed to the Federal Reserve Bank of Kansas City’s Omaha Branch Board in 2015 and, in 2018, was elected chair. His term on the Federal Reserve board ended in December 2020. He currently serves on the board of the Omaha Airport Authority, which he joined in 2007.

Skills and Qualifications: Mr. Butler developed and led strategic and financial planning, marketing, sales, commercial, and supply, procurement and purchasing for one of the largest transportation companies in the world, Union Pacific. He most recently led the corporate governance, human resources, labor relations and administration functions at Union Pacific. His knowledge of the railroad transportation industry and the challenges in maintaining top-tier safety, customer service and risk management standards while providing an important part of the nation’s infrastructure provides him with unique skills and insights that are valuable to offerthe Board. In addition, he has experience in the purchase of fuel and energy materials and equipment. As a unique technicalresult, Mr. Butler has an understanding of the aging infrastructure, safety, organizational and regulatory issues facing utilities today and provides a fresh viewpoint from an industry that is similarly positioned. His overall leadership experience and his regulated public company background provides the Board with another perspective on certainsignificant issues under consideration by the Board. As a long-time champion of humanitarian and social causes, including on behalf of the Lebanese-American community, Mr. Abdoo brings expertise and understanding with respect to social issues confronting the Company. His commitment to and work on behalf of social causes earned him the Ellis Island Medal of Honor, presented to Americans of diverse origins for their outstanding contributions to their own ethnic groups and to American society.that we face. | |

12 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | ARISTIDES S. CANDRIS | |

| | |

Aristides S. Candris, 64

Age: 70Director Since: 2012Standing BoardCommittees: Age: 70Director Since: 2012Standing BoardCommittees:■ Environmental, Safety and Sustainability Committee (Chair)

■ Nominating and Governance Committee | | 2012 |

| | |

Executive Experience: Dr. Candris was President and CEO of Westinghouse Electric Company (“Westinghouse”), Pittsburgh, Pennsylvania, a nuclear engineering company, which iswas a unit of Tokyo-based Toshiba Corp., from July 2008 until his retirement onin March 31, 2012. During his 36 years of service at Westinghouse, Dr. Candris served in various positions, including as Senior Vice President, Nuclear Fuel, from September 2006 to July 2008. Dr. Candris was also2008, and continued to serve on the board of Westinghouse until October 1, 20122012.

Outside Board and Other Experience: Dr. Candris served on the advisory board of Atomos Nuclear and Space Corporation from 2018 until 2020. He is also a directormember of the advisory boards of the Carnegie Institute of Technology and the Wilton E. Scott Institute for Energy Innovation at Carnegie Mellon University. He also serves on the boards of trustees of Transylvania University and the Hellenic-American University and the board of directors of The Hellenic Initiative. He previously served on the boards of Westinghouse and Kurion Inc. | | |

| |

Skills and Qualifications: Dr. Candris is a nuclear scientist and engineer and has significant experience gained through leading a global nuclear power company. His knowledge of the electric industry gives him significant insight onto the issues impacting the electric utility industry. His experience managing highly technical engineering operations, is valuableand particularly his extensive experience and expertise in risk assessment and safety management systems, as well as process optimization methodologies (such as Lean/Six Sigma), are of great value as we build and maintain facilities to address increasing environmental regulations and make long-term strategic decisions on electric power generation.generation and gas and electric delivery. His technical and management skills are helpful as we continue to build and modernize both our transmission and distribution systems. Dr. Candris’Candris has great insight from his experience developing customer focused programs and attaining excellence in business processes and behaviors, is insightful as wewhich will assist us to better meet the increasing expectations of customers and regulators. He serves | | |

2022 Proxy Statement | 13

2022 Proxy Statement | 13TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | DEBORAH A. HENRETTA | |

|  Name, AgeAge: 61Director Since: 2015Standing Board Committees:■ Audit Committee

■ Compensation and Principal Occupationsfor Past Five Years and Directorships Held

Human Capital Committee | | Has Been a

Director Since |

| | |

on the Boards of Carnegie Mellon University, Transylvania University and the Hellenic-American University. He also serves on the Board of Directors for The Hellenic Initiative.

| | |

| |

Wayne S. DeVeydt, 46

| | 2016 |

| |

Since May 2007, Mr. DeVeydt has served as

Executive Vice President and Chief Financial Officer (“CFO”) at Anthem, Inc., a health insurance company and an independent licensee of the Blue Cross and Blue Shield Association. Previously, he served as Senior Vice President and Chief Accounting Officer beginning in 2005 and Chief of Staff from 2006 to 2007. Prior to joining Anthem, Inc., Mr. DeVeydt served many roles from 1996 to 2005 at PricewaterhouseCoopers LLP, including lead engagement partner for a number of large companies in the national managed care and insurance industries. | | |

| |

Mr. DeVeydt’s current position as a CFO in a regulated industry at a public company and his former position as an engagement partner at a public accounting firm provides him with strong financial acumen along with a deep understanding of operating in a regulated industry and extensive leadership skills, particularly in the areas of accounting and finance. His significant experience in internal controls, capital markets, corporate governance, risk management and strategic planning from both a company and public accounting perspective makes him an asset to our Board. In addition, Mr. DeVeydt is an active leader in his community through his service as a board member of the U.S Chamber of Commerce and the Cancer Support Community, Central Indiana, and a member of the Boys & Girls Clubs of America Board of Governors.

| | |

| |

Joseph Hamrock, 52

| | 2015 |

| |

Mr. Hamrock has been our President and Chief Executive Officer since July 1, 2015, and prior to this appointment was our Executive Vice President and Group CEO for NiSource’s Gas Distribution Operations segment, comprised of local gas distribution companies in Kentucky, Maryland, Massachusetts, Ohio, Pennsylvania, and Virginia since May 2012. Prior thereto, he served in a variety of senior executive positions with American Electric Power (AEP), Columbus, Ohio, an electrical service public utility holding company, including President and Chief Operating Officer of AEP Ohio from January 2008 to May 2012, and leadership roles in engineering, transmission and distribution operations, customer service, marketing, and information technology. Mr. Hamrock received a bachelor’s degree in electrical engineering from Youngstown State University and a Master’s degree in business administration from the Massachusetts Institute of Technology, where he was a Sloan fellow.

| | |

| |

The Board believes it is important that the Company’s CEO serve on the Board. Mr. Hamrock has extensive knowledge of our industry gained through his 26 years’ experience in a variety of positions at AEP and augmented by his senior leadership experience with the Company. He began his career in the energy industry as an electrical engineer in transmission and distribution planning and went on to work in commercial and industrial customer services, earning a leadership role in commercial marketing, customer services, and strategic development among other executive roles. Consequently, he has a firm understanding of the needs of our customers and is uniquely qualified to lead a focused utility to meet customer commitments. Additionally, he has a solid understanding of our organization through his leadership of our gas distribution segment where he led financial, operational, regulatory and commercial performance for the Company’s gas distribution operations. This significant industry experience provides Mr. Hamrock with a unique perspective into the Company’s operations, our markets, our people and the strategic vision needed to meet our long-term business performance goals. In addition, he has been, and continues to be, an active supporter of educational, charitable and utility industry organizations. He is currently a board member of the American Gas Association and Mount Carmel College of Nursing, as well as several other community boards.

| | |

| | |

Experience: Name, Age and Principal Occupations for Past Five Years and Directorships Held

| | Has Been a

Director Since |

| |

Deborah A. Henretta, 54

| | 2015 |

| |

Ms. Henretta currently is a partner at Council Advisors company, where she serves as Senior Advisor tospearheading digital transformation practice for SSA & Company, an executive decision strategy consulting firm, following her retirementand is a senior advisor for G100 Companies, a C-suite learning and development company. She retired from Procter & Gamble Co. (“P&G”) in 2015, where she served as Group President of Global e-Commerce at P&G.e-Business. Prior to her appointment as Group President of Global e-Commercee-Business in January 2015, she held various senior positions throughout several P&G sectors, including as Group President of Global Beauty from 2012 to 2015 and served as Group President of P&G’s business in&G Asia from 2007 to 2012, as well as its Global Specialty Channel from 20112012. Prior to 2012. Before her appointment as a Group President in 2007,of P&G Asia, she was DivisionPresident Asia from 2005 to 2007 and President of Global Baby/Baby, Toddler &and Adult Care and Division Vice President of Fabric Conditioners and Bleach.from 2004 to 2005. She joined P&G in 1985. She

Outside Board and Other Experience: Ms. Henretta has been a director at Corning,American Eagle Outfitters, Inc. since 2013,2019, a director at Meritage Homes since 2017 and currently serves on its audit and corporate relations committees.a director at Corning Incorporated since 2013. Ms. Henretta becameserved as a director of Meritage Homes Corporation in 2016.Staples, Inc. from June 2016 until September 2017 and served on its compensation committee. Additionally, she serves on the Boardboard of Trusteestrustees for Xavier UniversitySt. Bonaventure and at Cincinnati Children’s Hospital Medical Center. | | |

| |

Syracuse Universities.

Skills and Qualifications:Ms. Henretta has over 30 years of business leadership experience with P&G in a multi-jurisdictional regulatory and competitive business environment. She has experience across many markets, that includes expertise in brand development,including P&L responsibility for multi-billion-dollar businesses at P&G and responsibility for strategic planning, sales, marketing, e-business, government relations and government relations.customer service. Ms. Henretta led a dynamic business segment and is, therefore, keenly aware of the delicate balance of keeping pace with customer expectations in a changing environment, as well as maximizing the benefits that inclusion and managing risk. During her long career at P&G she has held various leadership positions responsible for strategic planning, sales, marketing, government relations, and customer service in a multi-jurisdictional regulatory and competitive business environment.diversity can provide. Because of this experience, Ms. Henretta brings valuable insights to ourthe Board and strategic leadership to the Companyus as it operateswe operate in multiple regulatory environments and developsdevelop products and customer service programs to meet our customer commitments while providingcommitments. In her previous partner role at G100 Companies where she continues as an senior advisor, she assisted in establishing a rewarding work environment.Board Excellence Program, which provides board director education. | |

14 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | DEBORAH A. P. HERSMAN | |

| |  Age: 52Director Since: 2019Standing Board Committees: Age: 52Director Since: 2019Standing Board Committees:■ Environmental, Safety and Sustainability Committee

■ Finance Committee | | | Executive Experience: Ms. Hersman served as Chief Safety Officer and consultant at Waymo LLC, the self-driving car technology subsidiary of Alphabet Inc., from January 2019 to December 2020. In this role, she was responsible for systems safety, field safety and safety management systems across the company’s extensive testing and development programs. From 2014 to 2019, she served as president and CEO of the National Safety Council, a nonprofit organization focused on eliminating preventable deaths at work, in homes and communities, and on the road through leadership, research, education and advocacy.

Outside Board and Other Experience: From 2004 to 2014, Ms. Hersman served as a board member and then as chair at the National Transportation Safety Board (the “NTSB”). Previously, she served in a professional staff role for the U.S. Senate Commerce, Science and Transportation Committee, where she played key roles in crafting the Pipeline Safety Improvement Act of 2002 and legislation establishing a new modal administration focused on bus and truck safety. In 2021 she served on the Board of Velodyne (VLDR), a technology company that provides lidar solutions for autonomous vehicles, driver assistance, robotics, mapping and infrastructure applications.

Skills and Qualifications: Ms. Hersman is a seasoned safety executive, having previously served as the CEO of the National Safety Council and as the chair and chief executive at the NTSB. She has a successful track record running complex safety-focused organizations with numerous stakeholders. A widely respected safety leader driven by mission and a passion for preserving human life, Ms. Hersman also has expertise in the details of navigating crises and strong experience with safety policy legislation and advocacy. Ms. Hersman's extensive safety experience is of great value to the Board as we continue to implement our safety management system and meet our safety commitments to our customers and stakeholders. | |

| | MICHAEL E. JESANIS | |

Michael E. Jesanis, 59

|  Age: 65Director Since: 2008Standing Board Committees: Age: 65Director Since: 2008Standing Board Committees:■ Compensation and Human Capital Committee

■ Environmental, Safety & Sustainability Committee | 2008 |

| | |

Since July 2013,

Executive Experience: Mr. Jesanis has been a co-founderco-founded and was from 2013 to 2021 Managing Director of HotZero, LLC, a firm formed to develop hot water district energy systems in New Hampshire.England. Mr. Jesanis has also, since November 2007, been a principal with Serrafix, Boston, Massachusetts, a firm providing energy efficiency consulting and implementation services, principally to municipalities. Mr. Jesanis also servesserved as an advisor to several startups in energy-related fields. From July 2004 through December 2006, Mr. Jesanis was President and CEO of National Grid USA, a natural gas and electric utility, and a subsidiary of National Grid plc, of which Mr. Jesanis was also an Executive Director. Prior to that position, Mr. Jesanis was Chief Operating OfficerCOO and CFO of National Grid USA from January 2001 to July 2004.2004 and CFO of its predecessor utility holding company from 1998 to 2000.

Outside Board and Other Experience: Mr. Jesanis also is a board member of El Paso Electric Company. He previously served as a director offor several electric and energy companies, including Ameresco, Inc. | | |

| |

Mr. Jesanis is the former chair of the board of a college and a past trustee (and past chair of the audit committee) of a university.

Skills and Qualifications: By virtue of his former positions as President and CEO, Chief Operating OfficerCOO and, prior thereto CFO, of a major electric and gas utility holding company as well as his current role with an energy efficiency consulting firm, Mr. Jesanis has extensive experience with regulated utilities. He has strong financial acumen and extensive managerial experience, having led modernization efforts in the areas of operating infrastructure improvements, customer service enhancements and management team development. Mr. Jesanis also demonstrates a commitment to education as the former chair of the board of a college and a past trustee (and past chair of the audit committee) of anothera university. As a result of his former senior managerial roles and his non-profit board service, Mr. Jesanis also has particular expertise with board governance issues. | |

2022 Proxy Statement | 15

2022 Proxy Statement | 15TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | WILLIAM D. JOHNSON | |

| |  Age: 68Director Since: 2022Standing Board Committees: Age: 68Director Since: 2022Standing Board Committees:■ Compensation and Human Capital Committee

■ Environmental, Safety & Sustainability Committee | | | Executive Experience: Mr. Johnson most recently served as President and Chief Executive Officer of Pacific Gas & Electric Corporation, a utility company, from May 2019 through June 2020. Mr. Johnson also served as President and Chief Executive Officer of Tennessee Valley Authority, an electric utility company, from January 2013 to May 2019. Prior to joining Tennessee Valley Authority, Mr. Johnson held the positions of Chairman, President and CEO of Progress Energy, Inc. (“Progress”) from October 2007 to July 2012, and previously to that as President and Chief Operating Officer from 2005 to 2007. His career at Progress included leadership roles of increasing responsibility including as President, Energy Delivery from 2004 to 2005, President and Chief Executive Officer from 2002 to 2003, and Executive Vice President and General Counsel from 2000 to 2002 of Progress Energy Service Company. Mr. Johnson’s career began in 1992 at Carolina Power & Light Company (predecessor to Progress) where he held increasing senior management roles of Associate General Counsel and Manager, Legal Department; Vice President, Senior Counsel and Corporate Secretary and Senior Vice President and Corporate Secretary.

Outside Board and Other Experience: Mr. Johnson has been a director of TC Energy Corp. since June 2021, where he currently serves on the Audit Committee and Human Resources Committee. Mr. Johnson has also served on the boards of the following utility industry groups or associations: Edison Electric Institute as Vice Chair, Nuclear Energy Institute as Chair, Institute of Nuclear Power Operations, World Association of Nuclear Operators as Governor and Nuclear Electric Insurance Limited.

Skills and Qualifications: Mr. Johnson brings three decades of industry and leadership expertise to the Board. Mr. Johnson’s multiple tenures as CEO and vast experience with industry groups related to gas, electric, nuclear and other utilities provide him with extensive leadership skills in the utilities industry and a deep understanding of regulated industry operations. Mr. Johnson guided Pacific Gas & Electric Corporation through its emergence from bankruptcy and served as CEO of Progress during its merger with Duke Energy Corp., through which he gained significant experience in complex corporate restructuring, transactions, and strategy. His experience has also informed an understanding of safety and risk oversight in the utilities industry that the Board values. This extensive experience and depth of knowledge gives Mr. Johnson a strong perspective on strategic operations within the industry and makes Mr. Johnson a valuable asset to the Board. | |

16 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | KEVIN T. KABAT | |

Kevin T. Kabat, 59

|  Age: 65Director Since: 2015Chair of the BoardStanding Board Committees: Age: 65Director Since: 2015Chair of the BoardStanding Board Committees:■ Nominating and Governance Committee (Chair) | 2015 |

| | |

Executive Experience: From April 2007 to November 2015, Mr. Kabat was CEO of Fifth Third Bancorp.Bancorp, a bank holding company. He continuescontinued to serve as vice chairmanVice Chair of itsthe board of directors.directors of Fifth Third Bancorp until his retirement in April 2016. Before becoming CEO, he served as presidentFifth Third Bancorp’s President from June 2006 to September 2012 and was executive vice president of Fifth Third Bancorpas Executive Vice President from December 2003 to June 2006. Additionally, he was previously President and CEO of Fifth Third Bank | | |

| | |

Name, Age and Principal Occupations

for Past Five Years and Directorships Held

| | Has Been a

Director Since |

| |

(Michigan). Prior to that position, he was previously vice chairmanVice Chair and presidentPresident of Old Kent Bank, which was acquired by Fifth Third Bancorp in 2001. He

Outside Board and Other Experience: Mr. Kabat has been a director atof Unum Group since 2008. | | |

| |

2008 and is currently chair of the board and chair of its governance committee. He was also previously the lead independent director of E*TRADE Financial Corporation. He has also held leadership positions on the boards and committees of local business, educational, cultural and charitable organizations and campaigns.

Skills and Qualifications:Mr. Kabat has significant leadership experience as a CEO in a regulated industry at a public company. As a result, he has a deep understanding of operating in a regulatory environment and balancing the interests of many stakeholders. In addition, hisHis extensive experience in strategic planning, risk management, financial reporting, internal controls and capital markets and corporate governance makes him an asset to ourthe Board, becauseas he providesis able to provide unique strategic insight, financial expertise and risk management skills. In addition, he has broad corporate governance skills and perspective gained from his service in leadership positions on the boards of other publicly traded companies. | |

| | CASSANDRA S. LEE | |

| | |

Richard L. Thompson, 76

Age: 53Director Since: 2022Standing Board Committees: Age: 53Director Since: 2022Standing Board Committees:■ Audit Committee

■ Finance Committee | | 2004 |

| | |

Mr. Thompson has been our independent Chairman

Executive Experience: Ms. Lee is an experienced financial and operational leader with extensive knowledge of the telecommunication industry, currently serving as Chief Audit Executive for AT&T Inc. Ms. Lee joined AT&T in 1993 and has served in various leadership capacities, including Senior Vice President and Chief Financial Officer, Network, Technology and Capital Management.

Outside Board since May 2013. Prior to his retirement in 2004, Mr. Thompson was Group Presidentand Other Experience: Ms. Lee currently serves on the Board of Caterpillar Inc., Peoria, Illinois, a leading manufacturerDirectors of construction and mining equipment, diesel and natural gas engines and industrial gas turbines. In May 2015, Mr. Thompson retired as lead director of Lennox International, Inc., (“Lennox”)Andretti Acquisition Corp., a position he held since May 2012 following his service as Chairman ofspecial purpose acquisition company, where she chairs the Audit Committee. Ms. Lee serves on the Board from June 2006 to May 2012,of Directors for the Girl Scouts of Northeast Texas and Vice Chairman from February 2005 to June 2006. He began hisleads the Finance Committee.

Skills and Qualifications: In nearly three decades with AT&T, Ms. Lee has acquired a wealth of expertise in various areas including retail operations, distribution strategy, global supply chain, mergers, acquisitions, and integration, capital management, network and other capacity planning, and shared services operations. Her vast and multifaceted experience in the telecommunication industry will translate well in her service on the boardBoard. Ms. Lee also has significant public company financial oversight and leadership experience that will strengthen the Board’s depth of Lennox in 1993. Additionally, he was onfinancial acumen. Ms. Lee is a certified public accountant and veteran of the board of Gardner Denver Inc. from November 1998 to July 2013.United States Army. | |

2022 Proxy Statement | 17

2022 Proxy Statement | 17TABLE OF CONTENTS

PROPOSAL 1 — ELECTION OF DIRECTORS

| | LLOYD M. YATES | |

| | |

In his prior role as Group President of a large, publicly traded manufacturing company, Mr. Thompson had responsibility for its gas turbine and reciprocating engine business, as well as research and development activities. By virtue of this and prior positions, Mr. Thompson possesses significant experience in energy issues generally, and gas turbine electric power generation and natural gas pipeline compression in particular. He is a graduate electrical engineer with experience in electrical transmission system design and generation system planning. This experience provides Mr. Thompson a valuable understanding of technical issues faced by the Company.

| | |

| |

Carolyn Y. Woo,

Age: Age: 61 | | 1998 |

| |

Since January 2012, Dr. Woo has been

Director Since: 2020

President and CEO of Catholic Relief Services, the international humanitarian agency of the Catholic community in the United States. Prior thereto, Dr. Woo was Martin J. Gillen Dean and Ray and Milann Siegfried Professor of Entrepreneurial Studies, Mendoza College of Business, University of Notre Dame, Notre Dame, Indiana. Dr. Woo is also a director of AON Corporation.

since 2022

Standing Board Committees:

■ None | | |

| | |

Dr. Woo’s current position

Executive Experience: Mr. Yates has served as President and CEO of an international organization provides herNiSource since February 2022. Mr. Yates retired in 2019 from Duke Energy Corporation (“Duke Energy”), where he most recently served as Executive Vice President, Customer and Delivery Operations, and President, Carolinas Region, since 2014. In this role, he was responsible for aligning customer-focused products and services to deliver a personalized end-to-end customer experience to position Duke Energy for long-term growth, as well as for the profit/loss, strategic direction and performance of Duke Energy’s regulated utilities in North Carolina and South Carolina. Previously, he served as Executive Vice President of Regulated Utilities at Duke Energy, overseeing Duke Energy’s utility operations in six states, federal government affairs, and environmental and energy policy at the state and federal levels, as well as Executive Vice President, Customer Operations, where he led the transmission, distribution, customer services, gas operations and grid modernization functions for millions of utility customers. He held various senior leadership roles at Progress Energy, Inc., prior to its merger with knowledgeDuke Energy, from 2000 to 2012.

Outside Board and Other Experience: Mr. Yates currently serves on the board of directors of Marsh & McLennan Companies. He previously served on the board of directors of American Water Works Company Inc. until 2022 and Sonoco Products Company until 2022.

Skills and Qualifications: Mr. Yates brings significant energy and regulated utility experience to our Board. He has approximately 40 years of experience in managing a large organization. Her experience as the dean of a major business school and her experience as a professor of entrepreneurship provided her a deep understanding of business principles and extensive expertise with management and strategic planning issues. Through her current and previous service on the boards of directors, audit committees and compensation committees of a number of public companies,energy industry, including a global reinsurance and risk management consulting company, a pharmaceutical distribution company, an international automotive manufacturer and a financial institution, Dr. Woo has developed an excellent understanding of corporate governance, internal control, financial and strategic analysis and risk management issues. Dr. Woo is a leader in the areas of corporate social responsibilityprofit/loss management, customer service, nuclear and sustainability,fossil generation and energy delivery. At Duke Energy, he used his operational experience to improve safety, reliability and the overall customer experience for millions of customers. He has expertise overseeing regulated utility operations, working with state regulators, and managing consumer and community affairs. He also has experience managing gas and grid modernization functions, which adds an importantis valuable to our Board as we execute our business strategies. In addition, his experience as a director for other prominent public companies benefits our Board by bringing additional perspective to the Company. She is also a currentvariety of important areas of governance and past board member of several non-profit organizations, including an international relief organization, a global business school accreditation organization, leadership development organizations and an educational organization. This commitment to social and educational organizations provides Dr. Woo with an additional important perspective on the various community and social issues confronting the Company in the various communities that the Company serves.strategic planning. | | |

18 |  2022 Proxy Statement

2022 Proxy Statement TABLE OF CONTENTS

CORPORATE GOVERNANCE

Separation of Columbia Pipeline Group

On July 1, 2015 (the “Separation Date”), the Company completed the previously announced separation of CPG from the Company through thepro rata distribution of one share of CPG common stock for every one share of the Company’s common stock (the “Separation”). As a result of the Separation, CPG became an independent public company trading under the symbol “CPGX” on the NYSE, and NiSource continued as a fully regulated natural gas and electric utilities company.

In connection with the Separation, the Company’s Board changed as follows:

Sigmund L. Cornelius, Marty R. Kittrell, W. Lee Nutter, Deborah S. Parker, Robert C. Skaggs, Jr., and Teresa A. Taylor resigned from the Company’s Board, effective upon the Separation Date;

Joseph Hamrock, the Company’s President and Chief Executive Officer, and Deborah A. Henretta were elected to the Company’s Board, effective upon the Separation Date; and

Kevin T. Kabat was elected to the Company’s Board, effective as of July 3, 2015.

Also in connection with the Separation, the Officer Nomination and Compensation Committee was renamed the Compensation Committee and the Corporate Governance Committee was renamed the Nominating and Governance Committee.

Director Independence

Under our Corporate Governance Guidelines, a majority of the Board must be comprised of “independent directors.” In order to assist the Board in making its determination of director independence, the Board has adopted categorical standards of independence consistent with the standards contained in Section

303A.02(b)303A.02 of the NYSE

Corporate Governance Standards. The Board also has adopted an additional independence standard providing that a director who is an executive officer or director of a company that receives payments from theListed Company

in an amount which exceeds 1% of such other company’s consolidated gross revenues is not “independent” until three years after falling below such threshold.Manual. A copy of our Corporate Governance Guidelines is posted on our website at

http:https://ir.nisource.com/governance.cfmwww.nisource.com/investors/governance.

In considering Mr. Johnson’s independence, the Board considered the ordinary course and arms-length business relationship between subsidiaries of the Company and TC Energy Corp., where Mr. Johnson serves as a member of the board of directors. The Board has affirmatively determined that, with the exception of Mr.

Hamrock,Yates, all of the members of the Board and all nominees are “independent directors” as defined in Section

303A.02(b)303A.02 of the NYSE

Listed Company Manual and our Corporate Governance

Standards and meet the additional standard for independence set by the Board.Guidelines.

Policies and Procedures with Respect to Transactions with Related Persons

We have established policies and procedures with respect to the review, approval and ratification of any transactions with related persons.

Under its

Charter,charter, the Nominating and Governance Committee reviews reports and disclosures of insider and

affiliated partyrelated person transactions. Under

theour Code of Business Conduct, the following situations

may present a conflict of interest and must be reviewed

by the Nominating and Governance Committee to determine if they involve a direct or indirect interest of any director, executive officer or employee (including immediate family members) or otherwise present a

potential conflict of interest:

| ■ | owning more than a 10% equity interest or a general partner interest in any entity that transacts business with the Company (including lending or leasing transactions, but excluding the receipt of utility service from the Company at tariff rates), if the total amount involved in such transactions may exceed $120,000; |

| ■ | selling anything to the Company or buying anything from the Company (including lending or leasing transactions, but excluding the receipt of utility service from the Company at tariff rates), if the total amount involved in such transactions may exceed $120,000; |

| ■ | consulting for or being employed by a competitor of the Company; and |